California SDP FMS Models Explained: Bill Payer vs. Co-Employer vs. Sole Employer

Compare the three FMS models in the California Self-Determination Program. Discover 2025 FMS rates, liability differences, and how to choose the right provider.

The transition to the California Self-Determination Program (SDP) offers participants unprecedented freedom to design their own lives, but it also introduces a complex administrative landscape. At the heart of this system is the Financial Management Service (FMS) provider—a mandatory partner that handles the flow of funds from the Regional Center to your service providers.1

However, not all FMS relationships are created equal. The specific model you choose—Bill Payer, Co-Employer, or Sole Employer—fundamentally dictates who holds the legal liability for your staff, who handles insurance, and how much administrative burden falls on your shoulders.2

For many participants and families, this choice is the single biggest point of friction in the enrollment process. With the California Department of Developmental Services (DDS) protecting participants with new standardized rates effective January 1, 2025, the conversation has shifted from cost to compliance and capability.3

This guide breaks down the legal and operational differences between the three models to help you make an informed decision aligned with your family's risk tolerance.

Key Takeaways

- Mandatory Partnership: Every SDP participant must select an FMS provider; they act as the financial engine executing your spending plan.4

- Three District Models: You must choose between Bill Payer (Fiscal Agent), Co-Employer, or Sole Employer (Fiscal/Employer Agent).

- Liability Transfer: The Sole Employer model places 100% of the legal employer liability on you, requiring you to secure your own insurance.2

- The "Sweet Spot": The Co-Employer model allows you to manage staff while the FMS handles liability, insurance, and taxes.5

- 2025 Standardized Rates: As of January 1, 2025, FMS fees are fixed at $165 for Bill Payer and $265 for Sole/Co-Employer models.3

- Cost Protection: FMS fees are paid outside of your individual budget by the Regional Center; they do not eat into your service funds.2

The FMS Mandate in California's SDP

Under California Welfare & Institutions Code §4685.8, the use of a vendored Financial Management Service is not optional.1 The FMS serves as the neutral banking entity that ensures Medicaid funds are spent according to your person-centered plan.

It is critical to understand that the FMS does not approve services or dictate your budget. Their role is strictly administrative: they verify that the businesses you hire are legal entities, that your workers pass background checks, and that every dollar spent matches a line item in your spending plan.4 They are the guardrails that allow the state to hand you the keys to your budget.

1. The Bill Payer Model (Fiscal Agent)

The Bill Payer model, technically known as the Fiscal Agent model, is the most streamlined option but offers the least flexibility regarding who you can hire.

In this arrangement, you are typically purchasing services from established businesses or agencies rather than hiring individual employees. The FMS writes the check directly to the vendor (e.g., a gym, an art therapist's LLC, or a transportation company).2

Pros and Cons

- Liability: Lowest. You are not an employer. You have no payroll tax obligations and no worker's compensation requirements.6

- Flexibility: Limited. You generally cannot hire a neighbor or friend as a direct support professional (DSP) under this model unless they have their own business license and insurance.6

- Best For: Participants who strictly use their budget for goods (e.g., technology, equipment) and services from established community vendors.

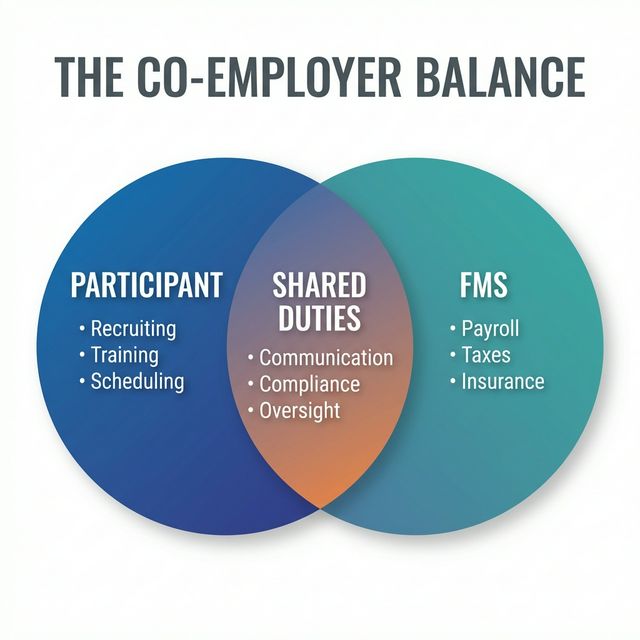

2. The Co-Employer Model

Widely considered the operational "sweet spot" for families, the Co-Employer model splits the difference between autonomy and protection.5

In this scenario, a "co-employment" relationship is established. The FMS acts as the Employer of Record for administrative purposes, while you act as the Managing Employer.2

How It Works

- Your Role: You recruit, interview, schedule, train, and dismiss your support workers. You maintain full control over who enters your home.2

- FMS Role: The FMS handles the heavy lifting of compliance. They maintain the Worker's Compensation policy, process all payroll taxes, and ensure adherence to California labor laws.7

This model is ideal for families who want to hire specific individuals (like a trusted cousin or a former aide) but want to avoid the headache of securing commercial insurance or auditing their own tax filings.5

3. The Sole Employer Model (Fiscal/Employer Agent)

The Sole Employer model (also called the Fiscal/Employer Agent) offers maximum control but transfers 100% of the risk to the participant.

Here, you are the employer. The FMS acts merely as your payroll software, cutting checks on your behalf, but the legal burden stops with you.2

The Administrative Burden

Choosing this model triggers serious legal obligations:

- EIN: You must obtain your own Federal Employer Identification Number.2

- Insurance: You are required to purchase and maintain your own Worker's Compensation insurance policy and liability insurance.2

- Liability: If an employee sues for wrongful termination or harassment, you are the defendant, not the FMS.8

While this model theoretically offers the most flexibility to negotiate uniform rates or specific employment terms, the data suggests that for most families, the administrative squeeze is rarely worth the juice.8

Comparison of FMS Models

The following table differentiates the legal and financial responsibilities across the three models.2

| Feature | Bill Payer (Fiscal Agent) | Co-Employer | Sole Employer |

|---|---|---|---|

| Legal Employer | The Vendor (Business) | Shared (FMS is Employer of Record) | The Participant |

| Who Holds the EIN? | N/A | The FMS | The Participant |

| Who Buys Insurance? | The Vendor | The FMS | The Participant |

| Liability Risk | None | Low (Shared) | High |

| Admin Burden | Low | Medium | High |

| Payment Type | Invoices to Businesses | Hourly Wages to Staff | Hourly Wages to Staff |

2025 FMS Rate Structures

Historically, FMS providers charged complex, tiered rates based on the number of checks cut per month. This system punished participants with active, diverse lives.

Effective January 1, 2025, the DDS simplified this structure into flat monthly fees under Directive C-2025-Rates-001.3

- Bill Payer (Service Code 490): $160 per month

- Sole / Co-Employer (Service Code 491): $265 per month

Crucial Note: These fees are paid outside of your individual budget.2 If your spending plan is $100,000, the Regional Center pays the FMS fee on top of that $100,000. You do not need to "save money" by choosing a cheaper model; you should choose the model that fits your operational needs.

Future Regulatory Outlook

The California landscape is moving toward standardization. Under AB 143, the DDS is mandated to develop consistent SDP policies across all 21 Regional Centers by March 2027.9

Currently, different Regional Centers (like Alta or RCEB) may have slight variations in how they interpret spending plan categories.10 The goal of AB 143 is to eliminate this "zip code lottery," ensuring that an FMS selection in Los Angeles grants the same operational clarity as one in Oakland.

Frequently Asked Questions (FAQ)

1. Who pays the FMS monthly fee?

The Regional Center pays the FMS fee directly. It is added on top of your certified individual budget, so it does not reduce the funds available for your services and supports.2

2. Can I switch FMS models later?

Yes. You can transition from Co-Employer to Sole Employer (or vice versa), but this requires updating your spending plan and potentially signing new agreements with your FMS. It may cause a temporary disruption in payroll if not timed correctly with pay periods.11

3. Why would anyone choose Sole Employer if it has high liability?

Some families choose Sole Employer to have absolute control over specific insurance policies or to implement unique employment contracts that a corporate FMS might not support. However, for the vast majority, the administrative burden outweighs these niche benefits.8

4. Does the Bill Payer model allow me to hire my neighbor?

Generally, no. The Bill Payer model is designed to pay legitimate businesses (vendors). If your neighbor does not have a business license and insurance, you would typically need to hire them as an employee under the Co-Employer or Sole Employer model.6

5. How do I know which FMS providers operate in my area?

The DDS maintains a list of vendored FMS providers. However, availability varies by capacity. You should interview FMS providers to ensure they are accepting new clients at your Regional Center.10

6. What happens if my FMS makes a payroll mistake?

In the Co-Employer model, the FMS is the Employer of Record and bears responsibility for payroll accuracy. In the Sole Employer model, while the FMS processes the check, the ultimate legal responsibility for labor law compliance rests with you.5

7. Do I need a separate budget for worker's compensation?

In the Co-Employer model, the FMS builds the cost of worker's compensation into the "employer burden" rate added to your employee's hourly wage. In the Sole Employer model, you must purchase a policy directly, and this cost is a line item in your spending plan.2

8. Can I use different FMS models for different services?

No. You select one FMS provider for your entire SDP case. However, that FMS can handle both "Bill Payer" transactions (for your gym membership) and "Co-Employer" transactions (for your staff) simultaneously under the single Service Code 491 fee structure.3

Conclusion

The selection of an FMS model is a foundational decision in your Self-Determination journey. It defines your legal exposure and your daily administrative workload.

For most participants, the Co-Employer model offers the ideal balance—granting you the authority to build your dream team while outsourcing the complex machinery of payroll and insurance to professionals. The Bill Payer model serves those with simple, vendor-based needs, while the Sole Employer model remains a niche option for those demanding total corporate independence.

With the 2025 rates standardized at $265 for employer models, the decision no longer needs to be driven by price. Choose the model that lets you focus less on paperwork and more on living a self-determined life.

Footnotes

-

Alta Regional Center Directive. Explains the foundational requirement of FMS under Welfare & Institutions Code §4685.8. Reliability: State Regional Center. ↩ ↩2

-

DDS FMS Models Comparison Chart. Details the exact division of labor between FMS and participants regarding taxes, hiring, and background checks. Reliability: Primary State Source (2021). ↩ ↩2 ↩3 ↩4 ↩5 ↩6 ↩7 ↩8 ↩9 ↩10 ↩11 ↩12 ↩13

-

DDS Directive C-2025-Rates-001. Mandates the new 2025 maximum FMS rates, establishing flat monthly fees. Reliability: Primary State Source (Feb 2025). ↩ ↩2 ↩3 ↩4

-

RCEB SDP Navigation Guide. Provides insight into how spending plans interact with FMS selection. Reliability: Regional Center Document. ↩ ↩2

-

Accura FMS Blog. A competitor breakdown of the models, noting the Co-Employer model hits the "sweet spot" for many families. Reliability: Industry Participant. ↩ ↩2 ↩3 ↩4

-

NeuroNav Bill Payer Analysis. Discusses the lack of flexibility inherent in the Fiscal Agent model. Reliability: High-ranking competitor asset. ↩ ↩2 ↩3

-

NeuroNav Co-Employer Analysis. Highlights the insurance procurement benefits of shared employer models. Reliability: High-ranking competitor asset. ↩

-

NeuroNav Sole Employer Analysis. Analyzes the risks and paperwork burdens associated with holding full employer responsibility. Reliability: High-ranking competitor asset. ↩ ↩2 ↩3

-

Undivided.io AB 143 Analysis. Details upcoming 2026-2027 standardization rules for SDP spending plans. Reliability: Special Education/Advocacy Platform. ↩

-

DDS FMS Contact List. Provides the database of vendored FMS providers across California's regional center system. Reliability: Primary State Source. ↩ ↩2

-

Support for Families FMS Guide. Details the practical implications of FMS models for families navigating the SDP. Reliability: Verified Advocacy Source. ↩